Tax is a concern of business owners. The dreaded audit notice from the Internal Revenue Service in the country you’re doing business in will keep you awake. Audits can be especially intimidating for small or midsize business owners as there is the potential to owe more in taxes on the business’s existing budget. Only about 1 in 100 businesses are audited each year. On top of that, there are a few simple things you can do to avoid the threatening eye of the Internal Revenue Service.

As a business owner, your chances of getting audited will skyrocket if you:

- Earn large sums of money annually, for example, over $1 million per year.

- Do not report all income.

- Claim business deductions that are disproportionate to the income of the business.

As the saying goes, “An ounce of prevention is worth a pound of cure” and we’re glad we’re here to offer tips that will help you avoid the audit surname.

Why are businesses audited?

In this article, we’ll take a look at six of the top reasons businesses fall for it, along with tips on how to stay out of an audit.

However, it should be noted that you may be audited for reasons beyond your control. The Internal Revenue Service uses a random selection to check some of your profits, and your profits could also be a target for testing because of something shady that one of your business partners or investors did.

How to avoid audited from the Internal Revenue Service

1. Limit entertainment events, business parties

You often organize parties, award ceremonies, or contests with large scale and extremely valuable prizes, then the advice is that you should limit it. Not for the expense, but it will get the attention of the Internal Revenue Service, which will then put you under their control.

Under the act, “the Tax Cuts and Jobs Act of 2017,” eliminated business-related entertainment deductions. So, if you’re trying to tweak the system to keep up with your annual customer appreciation night or parties, you’re raising a “red flag” for the Internal Revenue Service to notice you.

2. Don’t Overuse Deductions

As a hard-working business owner, you should only take the last deduction you’re entitled to. But you should also know that the Internal Revenue Service uses a computer program (Discriminate Income Function) to compare your deductions with other businesses that are in the same income bracket as you. So if the standard in your tax bracket has 12 deductions and you take 212 deductions, then you will get an audit notice from them. Or taking dozens of “miscellaneous” deductions isn’t a good idea either. You should only take deductions that are legal and you deserve.

CPA Jeffrey Levine says, “one of the biggest mistakes he sees small business owners make is not deducting legitimate business expenses like a home office for fear of being audited.”

According to Hector Garcia, CPA and QuickBooks consultant Hector Garcia, home office, business travel, and car mileage deductions are the most abused business deductions. So use them when appropriate, but know that the IRS is keeping an eye on you.

3. Incorporating or Forming a Limited Liability Company (LLC)

Small businesses are more often audited than LLCs. Because the Internal Revenue Service believes that small businesses are unstable in terms of their organization and financial capacity.

Therefore, incorporating a limited liability company (LLC) is important. In addition to lower audit risk, there are other compelling reasons to consider combinations:

- For many small business owners, personal assets (home, vehicle, savings) must also be paid back. to creditors if their business is in trouble. As for LLC, the capital is the “heart” of the whole company.

- Limited liability companies can get bank loans easier and quicker than small/private businesses.

- LLCs can take more deductions than small businesses (such as retirement and care plans. employee health care).

4. Be proactive about the unusual

You are a small business, but earn a lucrative contract or other money, increasing the income of the business to a huge number. So your income multiplies from previous years and suddenly the amount of deductions you get is unusually high. At this point, you will receive the attention of the Internal Revenue Service, and what you should do is proactively collect receipts for those transactions, contracts with local authorities, even documents. about your expansion plan and attach your earnings. It may take a little longer, but it will give you the initiative and may prevent the audit.

5. Do not file an amended tax return (unless necessary)

Filing an amended return is subjecting your business to audits. According to the IRS – the US Internal Revenue Service: “The filing of an amended return does not affect the original return selection process. However, the revised declarations are also subject to a screening process and the revised declaration may be selected for audit.”

In other words, your revised return will give the Internal Revenue Service an indication to check on you.

If necessary, because you forgot to calculate your legal deductions, just file an amended return. But you’re better off spending an extra hour or two getting it right the first time.

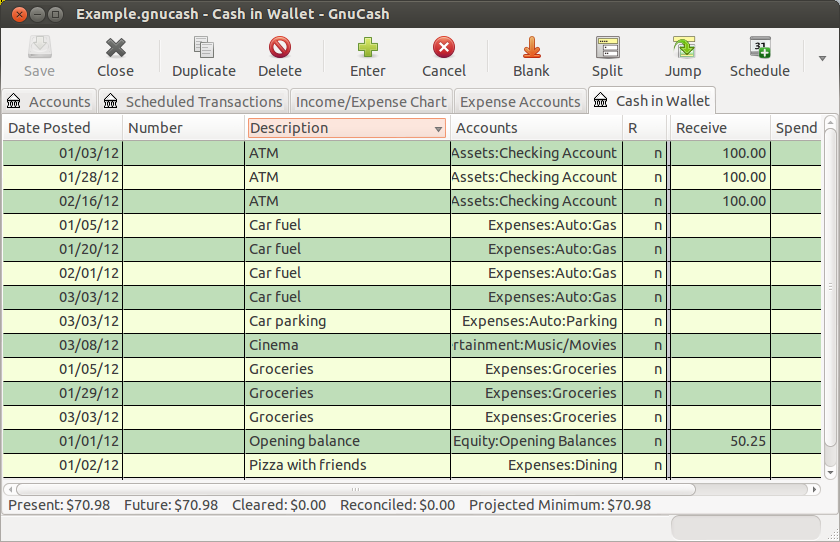

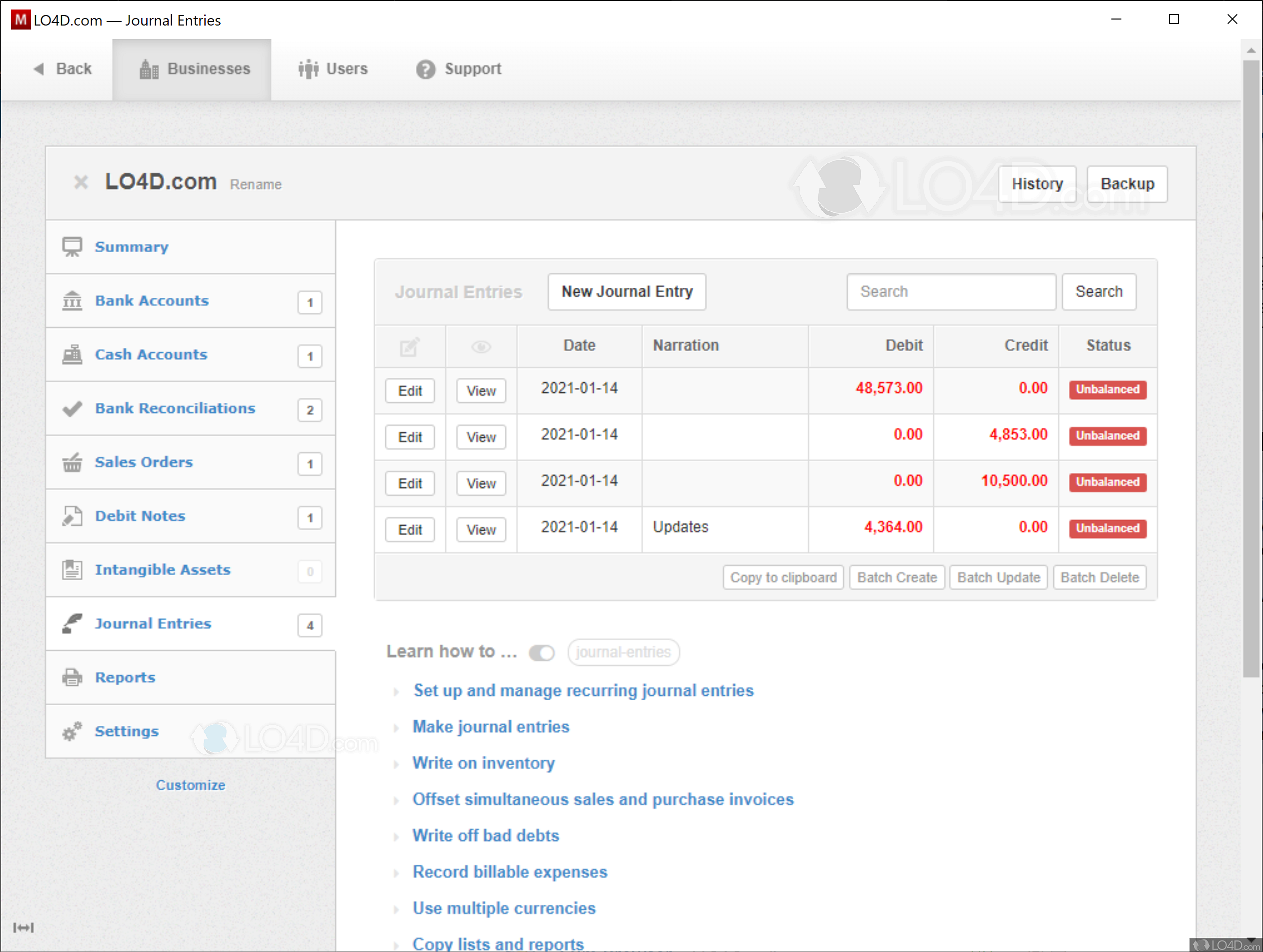

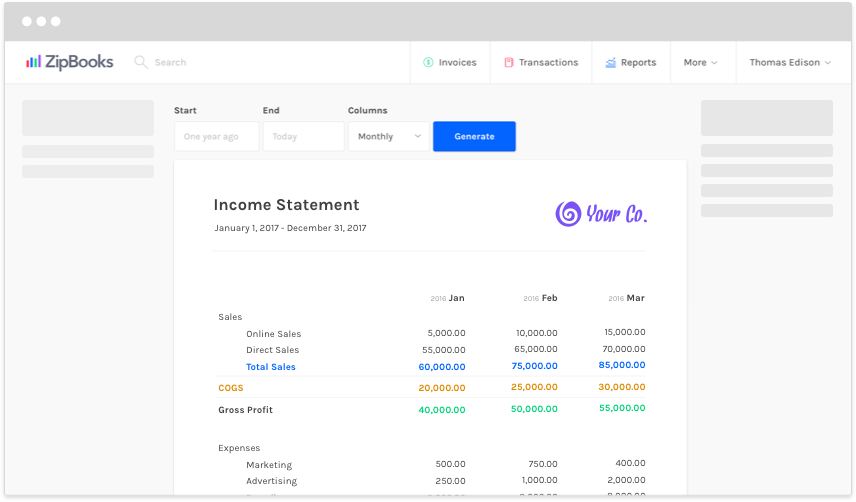

6. Taxation Technology

Why? According to e-file, the website of the IRS electronic filing system – Internal Revenue Service of the United States. “The error rate when returning documents is 21%. However, electronically filed affidavits produce an error rate of only half a percent.

“In other words: Paper returns have a higher risk of errors than returns filed electronically.

Other reasons to file electronically:

- Tax return software helps you find information on tax deductions you’re more likely to miss when using pen and paper.

- Through technology, you can save time, people, and money.

- Most tax preparation software includes audit alerts for things like deductions.

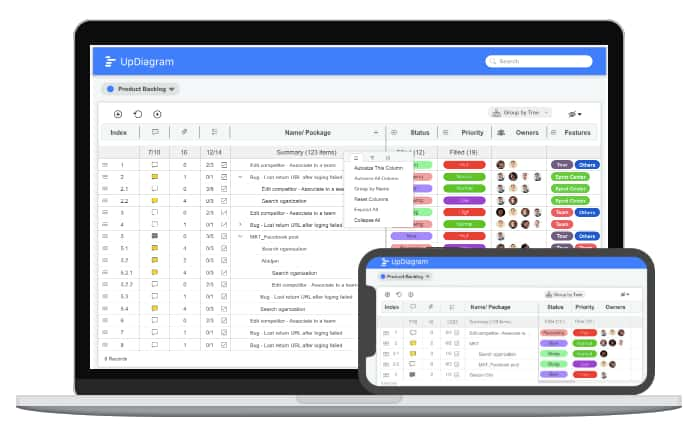

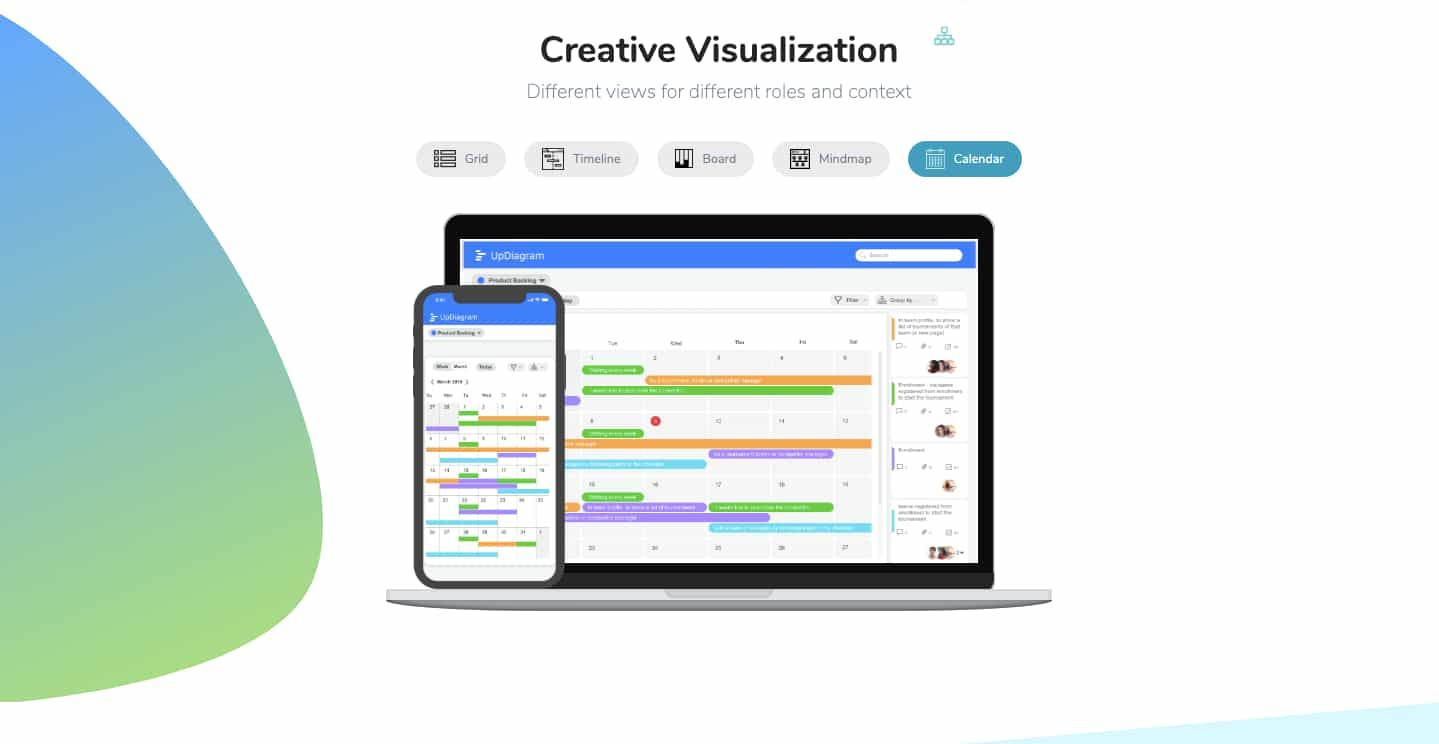

It would be great to combine your management software with your tax return software UpDiagram management software has the right functions for note-taking, summarizing, summarizing and time – the time function will remind you when your tax is due and you won’t be confused when it is due. Use UpDiagram for tax management and tax preparation software for optimization and avoidance audit by the Internal Revenue Service.